net operating working capital investopedia

Total net operating capital is an important input in calculation of free cash flow. Working capital or net current assets An accounting term denoting a firms short-term CURRENT ASSETS which are turned over fairly quickly in the course of business.

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statements_Reviewing_Cash_Flow_From_Operations_Oct_2020-01-5374391bf75040dfa769ad9661c90b89.jpg)

Cash Flow Statements Reviewing Cash Flow From Operations

Net operating working capital is a direct measure of a companys liquidity operational efficiency and its overall financial health at least in the short-term.

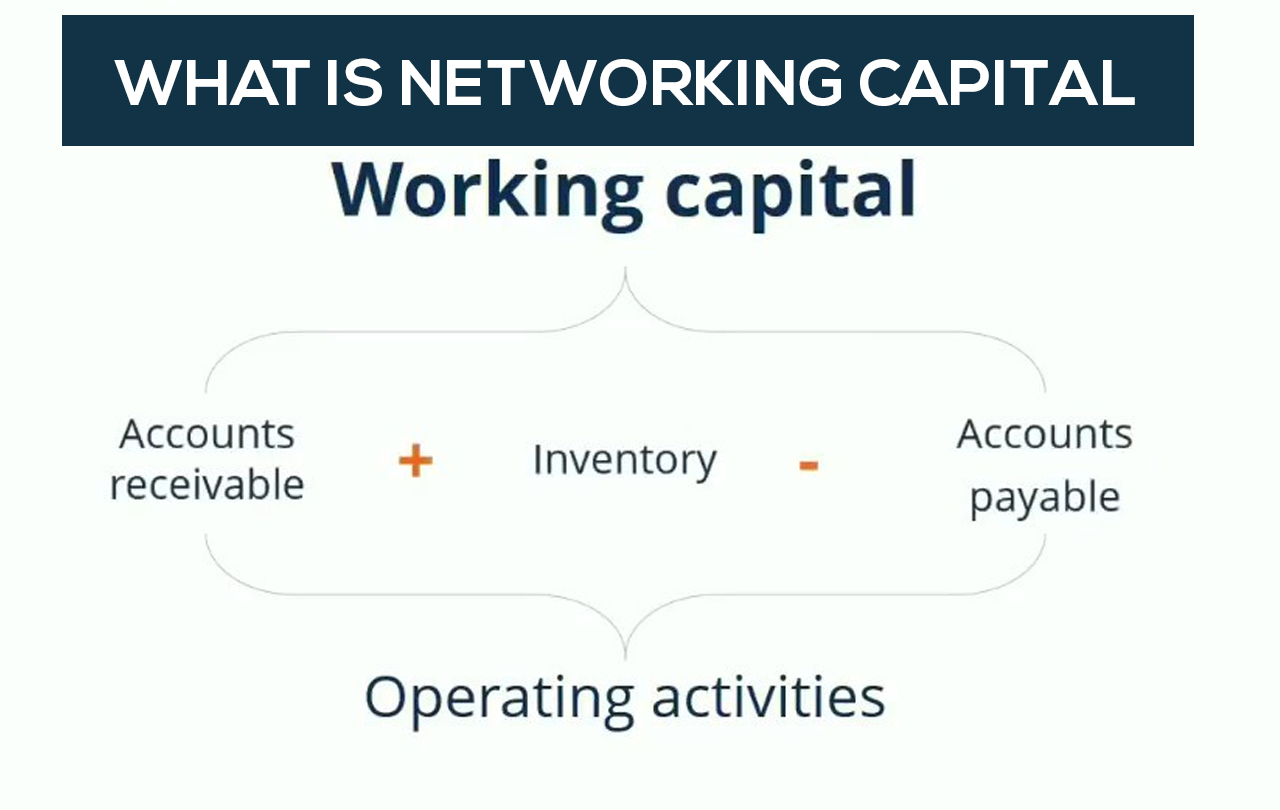

. Net operating assets are a businesss operating assets minus its operating liabilities. NOA is calculated by reformatting the balance sheet so that operating activities are separated from. Net operating working capital NOWC is the excess of operating current assets over operating current liabilities.

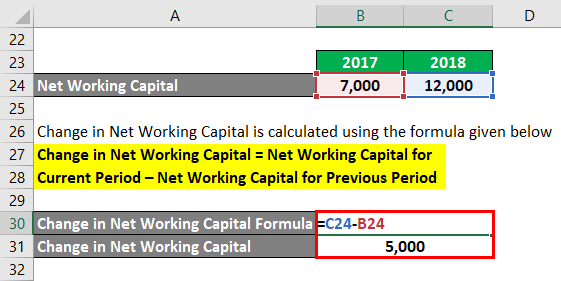

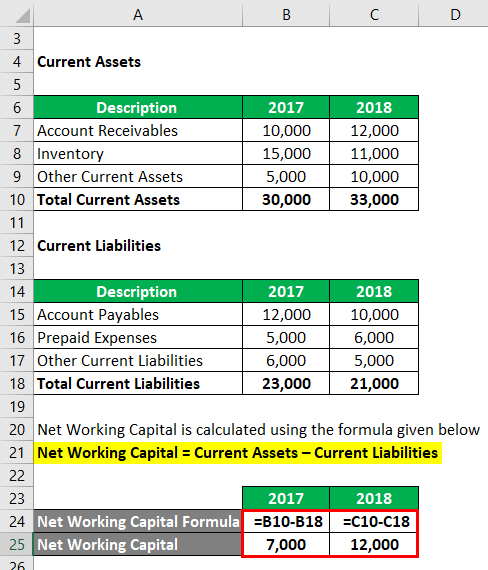

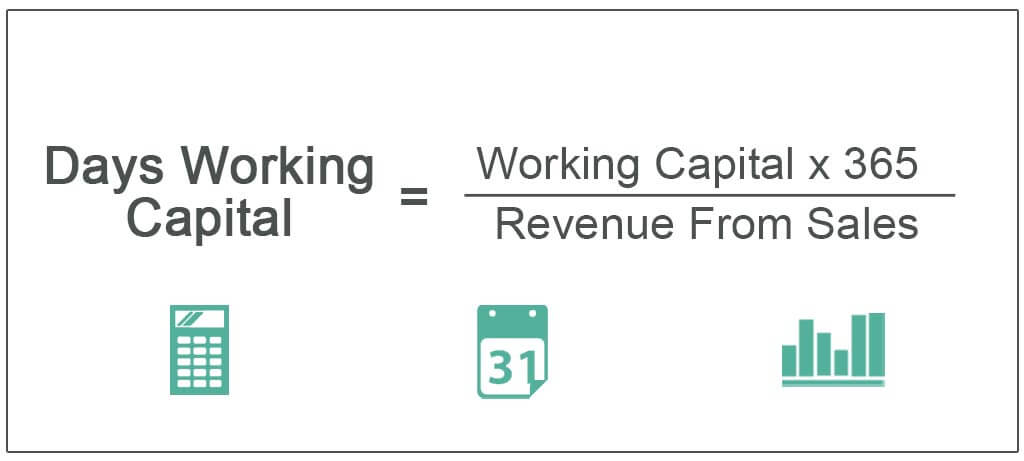

Say that Company A has 12 million in net sales over the previous 12 months. Working capital also known as net working capital is the difference between a companys current assets like cash accounts receivable and inventories of raw materials and. Those that do understand have a huge upper-hand in.

Net operating working capital NOWC is the difference between a companys current assets and current non-interest bearing current liabilities. It is a measure of a companys. By calculating the sum of each side the following values represent the two inputs required in the operating working capital formula.

More What Is Internal. Net operating working capital NOWC is a financial metric that measures a companys operating liquidity by comparing operating assets to operating liabilities. Current assets include cash.

Operating Current Assets 25 million 40 million 5. You can calculate net operating working capital by adding total Cash. The average working capital during that period was 2 million.

You can define net operating working capital or NOWC as a financial measure or ratio of a companys ability to assume its operating liabilities using its operational assets. Net operating working capital refers to the excess of operating current assets over current operating liabilities. The working capital turnover ratio is.

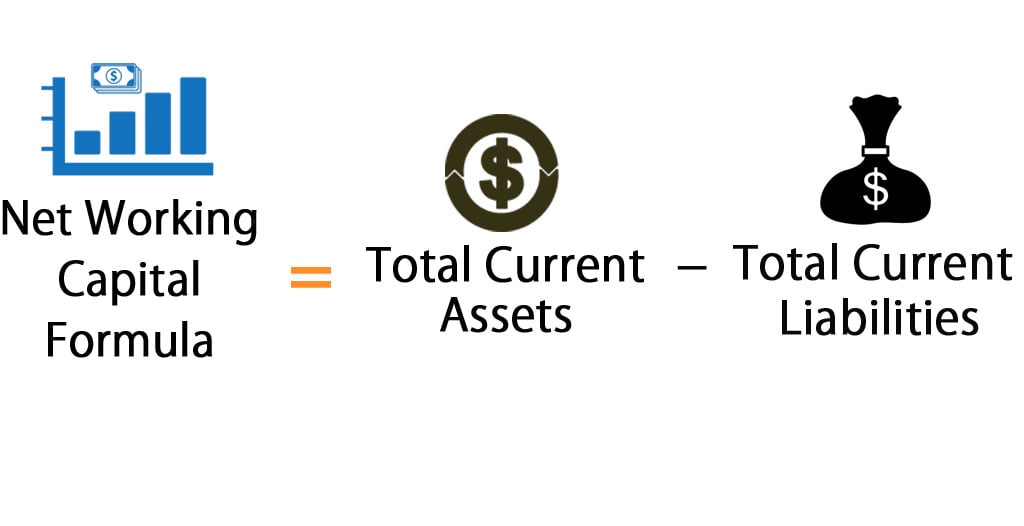

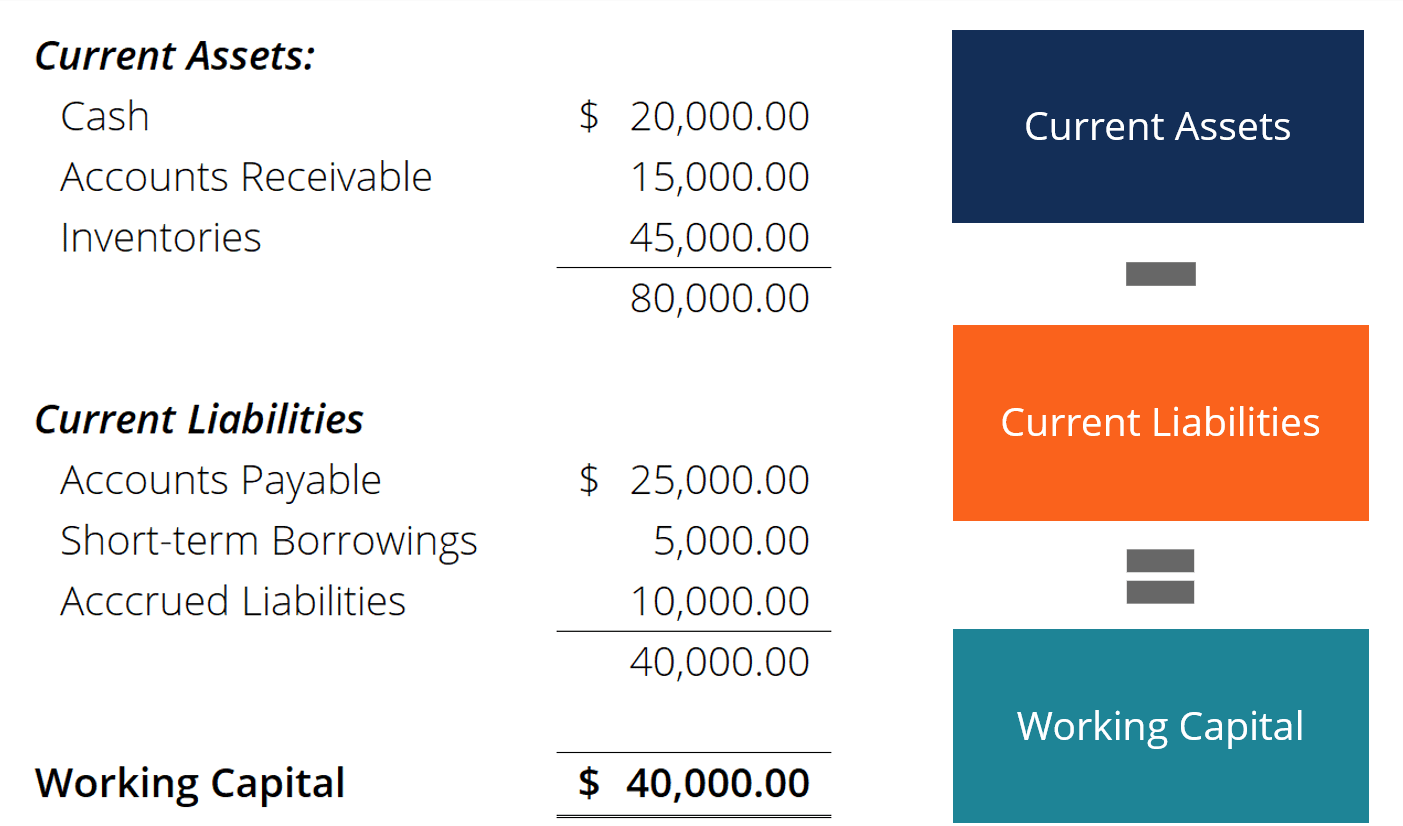

Net Working Capital Current Assets Current Liabilities. Net operating working capital refers to the excess of operating current assets over current operating liabilities. Free cash flow equals net operating profit after taxes minus change in total net operating.

Working capital or net working capital NWC is a measure of a companys liquidity operational efficiency and short-term financial health. Simply put Net Working Capital NWC is the difference between a companys current assets and current liabilities on its balance sheet. Working capital or net working capital NWC is a measure of a companys liquidity operational efficiency and short-term financial health.

How To Calculate Working Capital With Calculator Wikihow

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-03-2c4a6ea86c4b4b13b8a440cee78fac7d.jpg)

Free Cash Flow Fcf Formula To Calculate And Interpret It

Change In Net Working Capital Formula Calculator Excel Template

Change In Net Working Capital Formula Calculator Excel Template

Days Working Capital Definition Formula Calculation

What Is Tier 1 Capital Definition Ratio Core Capital Video Lesson Transcript Study Com

/dotdash_final_Optimal_Use_of_Financial_Leverage_in_a_Corporate_Capital_Structure_Dec_2020-01-33c6c3ed09c343f6a6693266ee856c8e.jpg)

Use Of Financial Leverage In Corporate Capital Structure

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

Deferred Tax Asset What It Is And How To Calculate And Use It With Examples

Net Working Capital Formula Calculator Excel Template

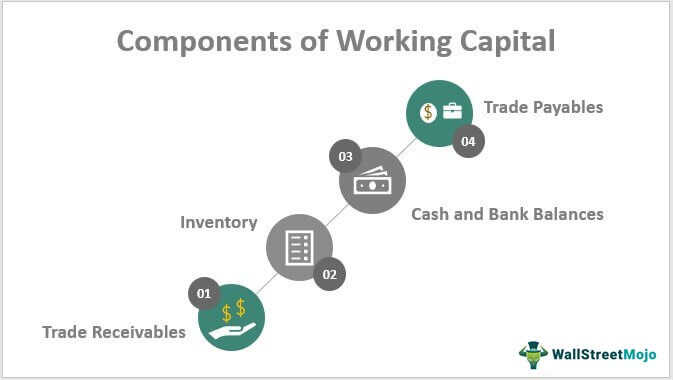

Components Of Working Capital Top 4 Detailed Explained

Operating Working Capital Owc Financial Edge

Working Capital Formula How To Calculate Working Capital

How Are Cash Flow And Free Cash Flow Different

A Complete Guide To Net Working Capital And How To Calculate It

/TermDefinitions_DeferredTax_V1-7bcdb89b942c43268debeb7043178732.jpg)

Deferred Tax Asset What It Is And How To Calculate And Use It With Examples

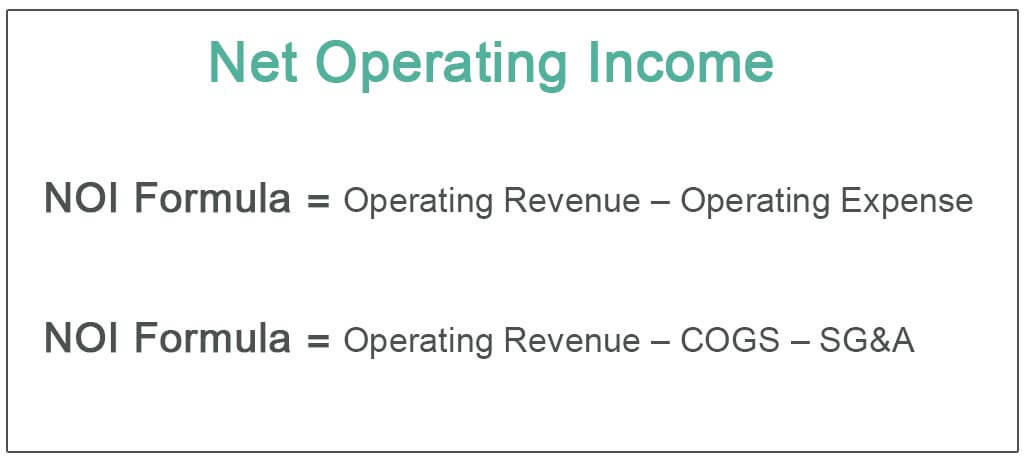

Net Operating Income Definition Examples What Is Noi

:max_bytes(150000):strip_icc():gifv()/WORKING-CAPITAL-FINAL-SR-16dac45bb5fb4f0cad62cd706c59e0cd.jpg)

/dotdash_Final_Free_Cash_Flow_to_the_Firm_FCFF_Sep_2020-01-f5a6d0cd933447618490bce0f60b57d1.jpg)

/imageedit_13_9492114505-9402b2fa1c05419ca6337a27f41d8329.jpg)